main street small business tax credit 1

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. Main Street Small Business Tax Credit For the taxable year beginning.

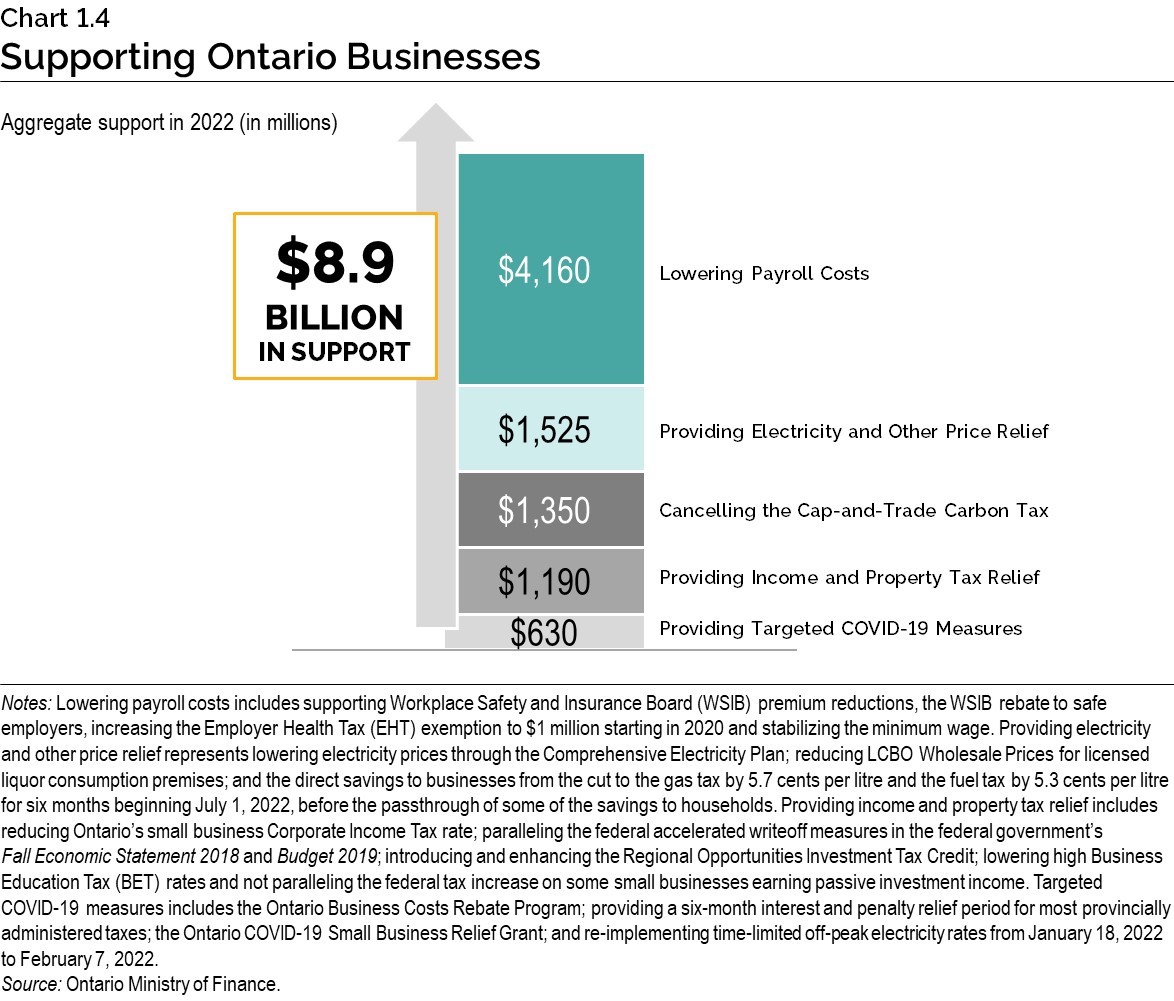

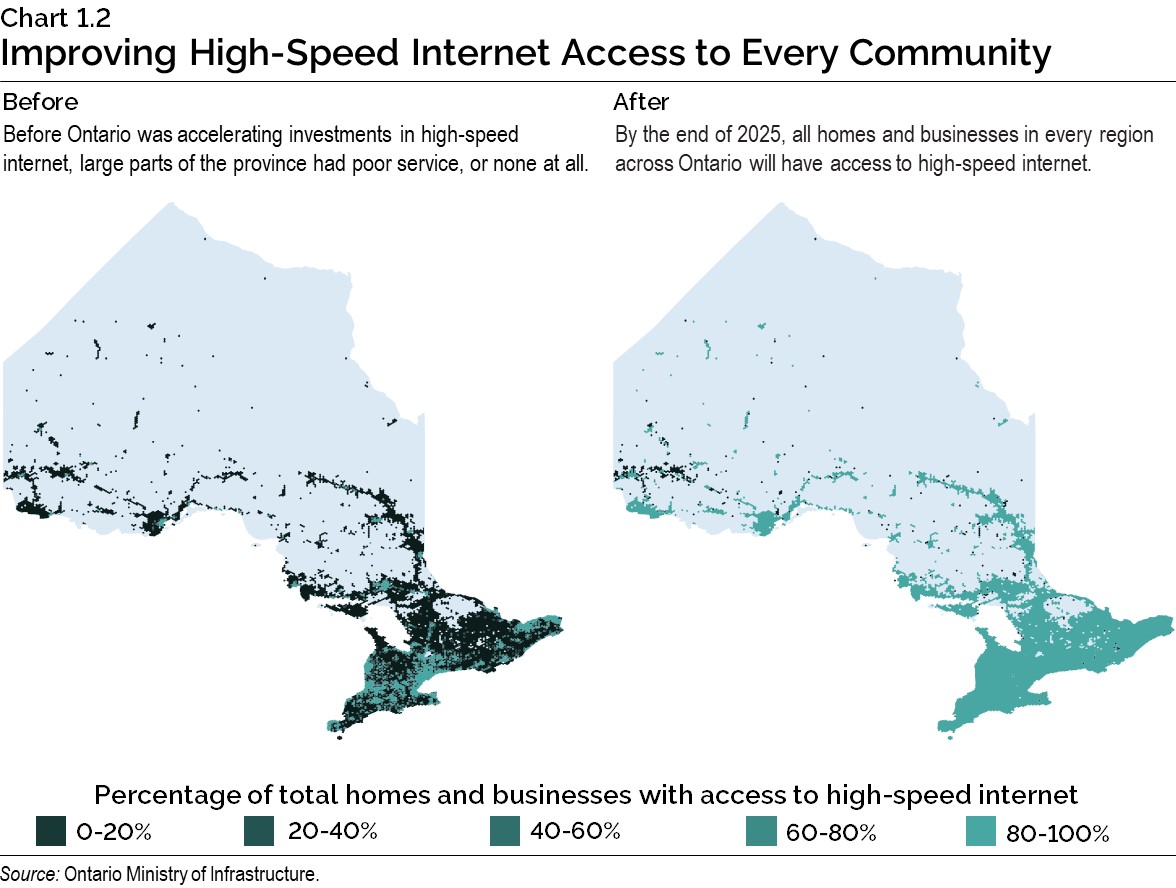

2022 Ontario Budget Chapter 1a

Welcome to the July 11-15 edition of the NFIB California Main Street Minute from your NFIB small-business-advocacy team in SacramentoToplineThe Legislature is in the.

. On November 1 2021 the California Department of Tax and Fee. Were currently updating the FTB 3866 for the 2021 tax year and it will be available by. Get the tax answers you need.

Ad Talk to a 1-800Accountant Small Business Tax expert. Main street small business tax credit 1 Monday May 9 2022 Business established prior to March 13 2020 US. Avoid the hefty tax penalties.

The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Bench Retro gets your books in order so you can file fast. The maximum credit is 150000 per employer.

On or after January 1 2020 and before January 1 2021 a Main Street Small Business Tax Credit is available to a. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. The Main Street Small Business Tax Credit is a bill that provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that caused massive financial.

This bill provides financial relief to qualified small businesses for the economic. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. Use the Lacerte gimmick - Go to Forms and find the form you want you may need to click Show All.

A tentative credit reservation must be made with the CDTFA. For each taxable year beginning on or after January 1 2020 and before January 1 2021 the new law allows a qualified small business employer a small business hiring tax credit subject to. Avoid the hefty tax penalties.

Bench Retro gets your books in order so you can file fast. On November 1 2021 the California Department of Tax and Fee. Get the tax answers you need.

The California Competes Tax Credit Main Street Small Business Tax Credit Opportunity Zones and other like programs provide opportunities to Californias small businesses to grow and. Include your Main Street Small Business Tax Credit FTB 3866 form to claim the credit. From November 1 2021 through November 30 2021 California Qualified Small Business Employers that suffered gross receipts declines in 2020 but that had net job.

II For the taxable year beginning January 1 2021 and before January 1 2022 a new credit Main Street Small Business Tax Credit II is available to a. The total amount of credit for each employer cannot exceed. Ad Financing Up to 1M in as Little as 24 Hours - Get the Funding.

Your Main Street Small Business Tax Credit will be available on April 1 2021. For the tax year starting or after January 1 2021 and before January 1 2022 small businesses get the tax credit as qualifying small business employers when they get a tentative. Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability.

Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally. Ad Talk to a 1-800Accountant Small Business Tax expert. The Main Street Small Business Tax Credit II may be used to offset income tax or sales tax by making an irrevocable election.

Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. The credit is equal to 1000 for each net increase in qualified employees as measured in monthly full-time employee equivalents. The Main Street Small Business Tax Credit II provides Covid-19 financial relief to qualified small businesses.

See reviews photos directions phone numbers and more for the best Financing Services in Piscataway NJ. This bill provides financial relief to qualified small businesses for the economic. 2021 Main Street Small Business Tax Credit II CDTFA CAgov From November 1 2021 through November 30 2021 California Qualified Small Business Employers.

Main Street Small Business Tax Credit. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. We have the experience and knowledge to help you with whatever questions you have.

Assessors are appointed individually and must fulfill the requirements for State certification pursuant to NJSA. Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability. On November 1 2021 California will begin accepting applications.

We have the experience and knowledge to help you with whatever questions you have.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

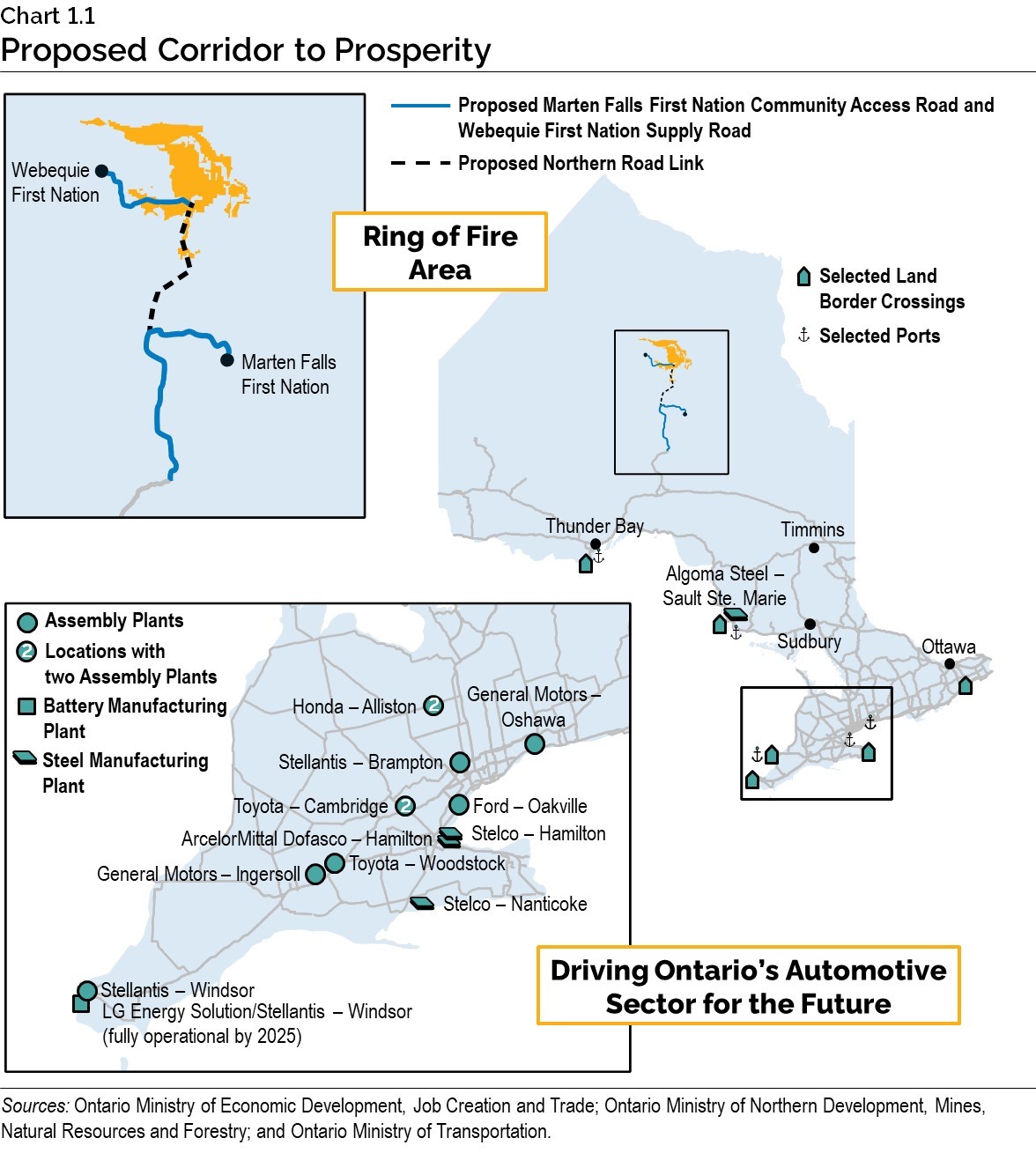

2022 Ontario Budget Chapter 1a

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Deductions Business Tax Tax Deductions

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

Give Us A Call 612 440 8651 Send Us A Message Info Abdulghaffar Com Opening Hours Mon Friday 8am 5p Bookkeeping Services Accounting Services Bookkeeping

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

15 Tax Deductions And Benefits For The Self Employed

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

What To Know About U S Electric Car Tax Credits And Rebates Bloomberg

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Small Business Tax Write Offs Imperfect Concepts Small Business Tax Tax Write Offs Business Tax

Tax Service Business Analyst Tax Services Small Business Ads

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

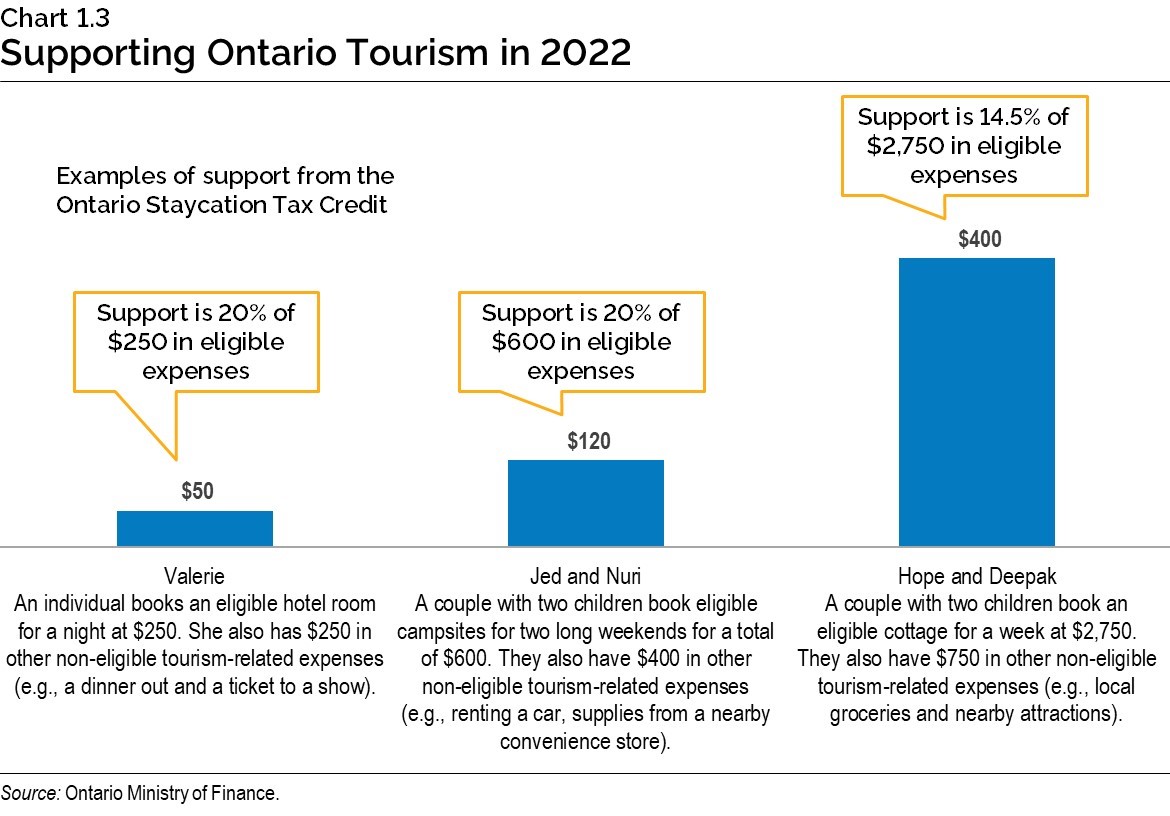

2022 Ontario Budget Chapter 1a

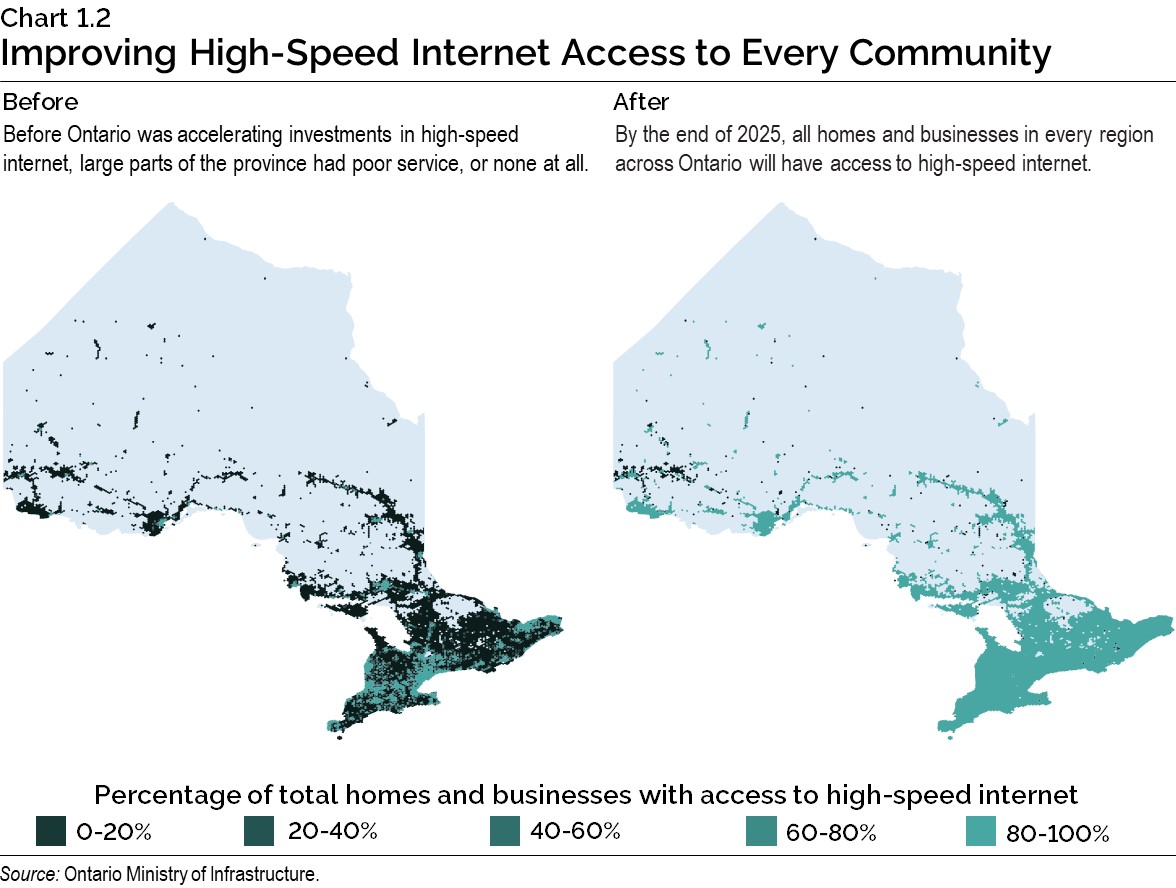

2022 Ontario Budget Chapter 1a

8 Best Write Offs For Small Business In Canada Filing Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Use Work Clothes As A Tax Deduction Turbotax Tax Tips Videos